Have you ever thought about the cost of long term care and how to pay for it? If you haven't, you may be shocked.

How expensive is long term care?

U.S. national median annual costs, according to the Genworth 2017 Cost of Care Survey:

- Adult day health care: $18,200

- Assisted living facility: $45,000 ($3750/mo.)

- Home health aide: $49,192 (40 hrs/wk x $22/hr) (approx)

- Skilled nursing private room: $97,455

Will medicare cover long term care?

Don’t plan on Medicare being a funding option for long-term care, since Medicare will pay only for skilled services provided by medical professionals. For Medicare to pay any costs, the beneficiary must have been hospitalized for a minimum of three days. There are other requirements as well.

how does medicaid work?

Medicaid is the program that provides government assistance for long-term care. To qualify, you must meet financial requirements, which may impact both assets and income. In most states, Medicaid will cover long-term care only after you’ve spent down your assets. There's a 5-year look back period as well, so preparing to use Medicaid requires expert help.

Long term care insurance coverage

Long-term care insurance generally offers coverage for in-home care and assisted living, independent living or memory care in senior living communities. Long-term care insurance may also cover community-based services such as adult day care or hospice care. Most policies include coverage for a case manager or care coordinator.

To trigger eligibility for benefits, you must be chronically ill, meaning the policyholder is unable to complete at least two activities of daily living (ADLs) without substantial assistance from another person for at least 90 days or be cognitively impaired. A limited number of policies may have a more lenient “medically necessary” trigger for benefits.

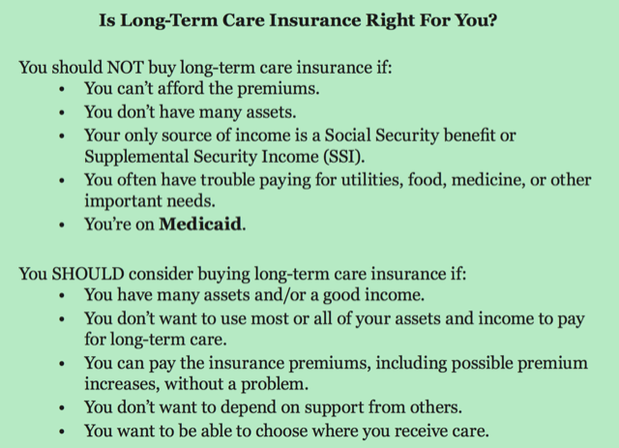

As a general rule of thumb, the chart below provides an excellent guide....

To trigger eligibility for benefits, you must be chronically ill, meaning the policyholder is unable to complete at least two activities of daily living (ADLs) without substantial assistance from another person for at least 90 days or be cognitively impaired. A limited number of policies may have a more lenient “medically necessary” trigger for benefits.

As a general rule of thumb, the chart below provides an excellent guide....

how to shop and buy long term care insurance

Shopping for life insurance with a long term care rider can be daunting. Before making a purchase decision, its important to do your homework.

What to look for in brokers who sell long-term care insurance:

What to look for in brokers who sell long-term care insurance:

- A broker or company with a process in place to stay in touch with clients

- A broker who has experience helping clients file claims

- A broker who has sold a lot of policies and works with multiple carriers

- Someone who specializes in long-term care policies

RSS Feed

RSS Feed